Tax Bill Information

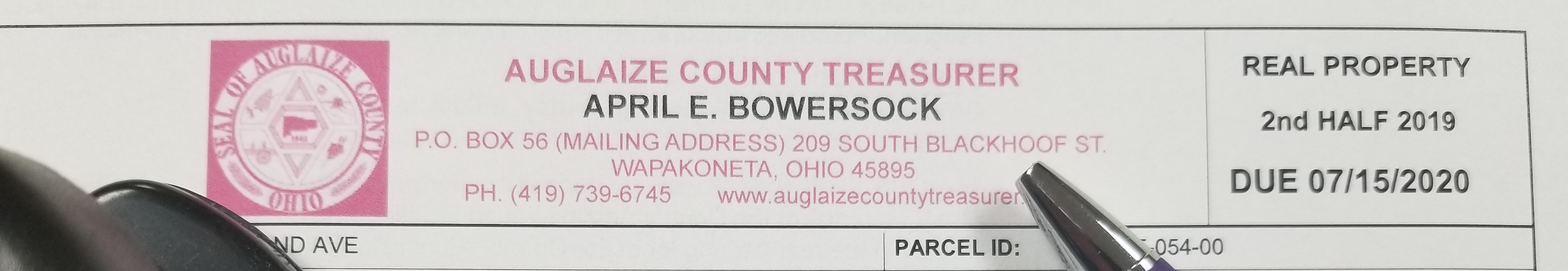

Real Estate

Real Estate Tax bills are due by February 17th and July 15th (or the first following business day if the 15th falls on a weekend or holiday.). These bills are mailed within a month before the due date. Real Estate taxes are always paid a year behind . The office accepts checks, cash, MasterCard, Visa or Discover.

Manufactured Home

Manufactured home taxes are due February 17th and July 15th (or the first following business day if the 15th falls on a weekend or holiday.).

Sewer

Sewer Bills are due quarterly in January, April, July and October.

Escrow

We do have an Escrow Plan for the Real Estate Taxes as well as the Manufactured Home Taxes. These programs start in August each year. Payments are automatically deducted monthly or coupons are issued for monthly payments.

Delinquent Taxes

There is also a Delinquent Tax payment plan. We will enter into a contract plan for you to pay your delinquent taxes by the month. Manufactured Homes and Real Estate both have these plans. Contact or stop in the Treasurer's Office to make arrangements.

The following notice to comply with R.C. 323.131(A)(3)(a):

“Notice: If the taxes are not paid within sixty days from the date they are certified delinquent, the property is subject to foreclosure for tax delinquency.”

Tax Bill Information

Real Estate

Real Estate Tax bills are due by February 17th and July 15th (or the first following business day if the 15th falls on a weekend or holiday.). These bills are mailed within a month before the due date. Real Estate taxes are always paid a year behind . The office accepts checks, cash, MasterCard, Visa or Discover.

Manufactured Home

Manufactured home taxes are due February 17th and July 15th (or the first following business day if the 15th falls on a weekend or holiday.).

Sewer

Sewer Bills are due quarterly in January, April, July and October.

Escrow

We do have an Escrow Plan for the Real Estate Taxes as well as the Manufactured Home Taxes. These programs start in August each year. Payments are automatically deducted monthly or coupons are issued for monthly payments.

Delinquent Taxes

There is also a Delinquent Tax payment plan. We will enter into a contract plan for you to pay your delinquent taxes by the month. Manufactured Homes and Real Estate both have these plans. Contact or stop in the Treasurer's Office to make arrangements.

The following notice to comply with R.C. 323.131(A)(3)(a):

“Notice: If the taxes are not paid within sixty days from the date they are certified delinquent, the property is subject to foreclosure for tax delinquency.”